Medicare Supplement

Learn more by calling Amarillo Insurance Connection in Amarillo, TX

Why Should You Get A Medicare Supplement Insurance Plan?

Original Medicare pays for many, but not all, health care services and supplies. A Medigap policy, sold by private insurance companies, can help pay some of the health care costs ("gaps") that Original Medicare doesn't cover, like copayments, coinsurance, and deductibles. Some Medigap policies also offer coverage for services that Original Medicare doesn't cover, like medical care when you travel outside the U.S. If you have Original Medicare and you buy a Medigap policy, Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then your Medigap policy pays its share. Medicare doesn't pay any of the premiums for a Medigap policy.

Every Medigap policy must follow Federal and state laws designed to protect you, and it must be clearly identified as "Medicare Supplement Insurance." Medigap insurance companies can sell you only a "standardized" Medigap policy identified in most states by letters. All plans offer the same basic benefits but some offer additional benefits, so you can choose which one meets your needs.

Note: In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way.

Medigap (Medicare Supplement Insurance) Policies

Types of Medigap Plans For Residents in Amarillo, TX

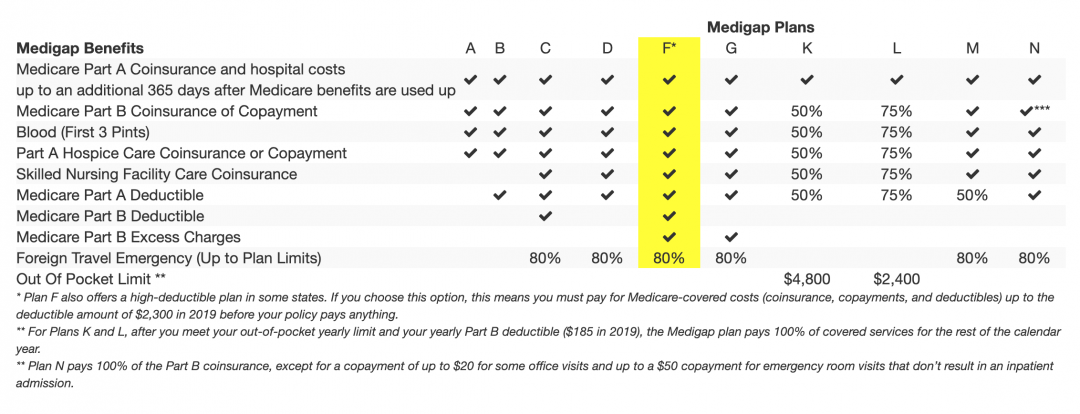

How to read the chart: If a check mark appears in a column of this chart, the Medigap policy covers 100% of the described benefit. If a row lists a percentage, the policy covers that percentage of the described benefit. If a row is blank, the policy doesn't cover that benefit. Note: The Medigap policy covers coinsurance only after you have paid the deductible (unless the Medigap policy also covers the deductible).

Insurance companies may charge different premiums for exactly the same Medigap coverage. As you shop for a Medigap policy, be sure you're comparing the same Medigap policy (for example, compare Plan A from one company with Plan A from another company).

In some states, you may be able to buy another type of Medigap policy called Medicare SELECT (a Medigap policy that requires you to use specific hospitals and, in some cases, specific doctors to get full coverage). If you buy a Medicare SELECT policy, you also have rights to change your mind within 12 months and switch to a standard Medigap policy.

More About How Medigap Policies Work

- You must have Part A and Part B.

- You pay a monthly premium for your Medigap policy in addition to your monthly Part B premium.

- A Medigap policy only covers one person. Spouses must buy separate policies.

- It's important to compare Medigap policies since the costs can vary and may go up as you get older. Some states limit Medigap costs.

- The best time to buy a Medigap policy is during the 6-month period that begins on the first day of the month in which you're 65 or older and enrolled in Part B. (Some states have additional open enrollment periods.) After this enrollment period, your option to buy a Medigap policy may be limited and it may cost more. For example, if you turn 65 and are enrolled in Part B in June, the best time for you to buy a Medigap policy is from June to November.

- If you're under 65, you won't have this open enrollment period until you turn 65, but state law might give you a right to buy a policy before then.

- If you have a Medigap policy and join a Medicare Advantage Plan (like an HMO or PPO), you may want to drop your Medigap policy. Your Medigap policy can't be used to pay your Medicare Advantage Plan copayments, deductibles, and premiums. If you want to cancel your Medigap policy, contact your insurance company. If you drop your policy to join a Medicare Advantage Plan, in most cases you won't be able to get it back.

- If you have a Medicare Advantage Plan, it's illegal for anyone to sell you a Medigap policy unless you're switching back to Original Medicare. Contact your State Insurance Department if this happens to you.

Information provided by: Medicare and You Handbook

Reach out to Amarillo Insurance Connection in Amarillo, TX to learn more information or if you have any questions.

Best Medicare Supplement Insurance Companies

Determining the "best" Medicare Supplement insurance companies can depend on factors like coverage options, customer satisfaction, financial stability, and pricing. While I can't provide real-time data, I can mention some well-regarded companies that have historically offered competitive Medicare Supplement plans:

- AARP UnitedHealthcare: AARP partners with UnitedHealthcare to offer Medicare Supplement plans, known for their extensive coverage options and competitive rates.

- Cigna: Cigna is known for its strong customer service and a range of Medicare Supplement plans that cater to various healthcare needs.

- Anthem Blue Cross Blue Shield: Anthem offers Medicare Supplement plans across different states, often with a reputation for providing comprehensive coverage.

- Humana: Humana provides a variety of Medicare Supplement plans and has a strong presence in the Medicare market.

- Mutual of Omaha: Mutual of Omaha is a well-known provider of Medicare Supplement plans, often praised for its straightforward and transparent approach.

- Aetna: Aetna offers Medicare Supplement plans with various coverage options and competitive rates.

When considering Medicare Supplement insurance companies, it's important to:

- Research Plans: Compare the specific plans each company offers to find one that aligns with your healthcare needs.

- Check Ratings: Look at customer reviews, online ratings, and third-party evaluations of the company's customer service and financial stability.

- Compare Costs: Premiums can vary widely, so compare pricing from different companies for the same plan.

- Check Network: Unlike Medicare Advantage, Medicare Supplement plans usually allow you to visit any doctor or hospital that accepts Medicare. Still, it's good to ensure that your preferred providers accept the insurance.

- Understand Enrollment: Enroll during your Medigap Open Enrollment Period to guarantee access to the plan you want without medical underwriting.

Before making a decision, consider working with a

licensed insurance agent who can provide personalized advice based on your specific situation and needs.